There was consensus among speakers the Block Chain Conference in San Francisco last week that collaboration toward a “scalable standard for blockchain technology” was essential for its adoption by the global financial industry.

The conference also determined that the blockchain ecosystem has been successful in educating financial industry professionals and regulators about blockchain technology. There was now an active evaluation process underway among major institutions and enterprises about developing standards and implementation of blockchain tech in financial systems.

Meghan Elison of Ripple, highlights developments succinctly here:

This industry-wide trend toward collaboration marks the coming of the next phase in blockchain’s maturation: initiating network effects. Cooperation and interoperability were cited as the reason that so many distributed financial technology providers have worked to create or join consortiums and working groups. The Internet of Value takes form as network effects build, so its fabric really depends on industry (and cross-industry) cooperation.

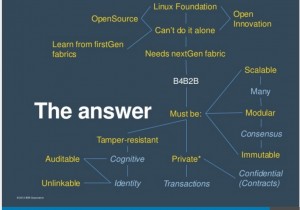

The conference keynote speaker IBM’s Blockchain Offering Director, John Wolpert, focused on the need for industry collaboration to generate the same kind of paradigm shift that occurred with Java, XML, or Linux.

Most noteworthy, John Bertrand of SAP highlighted use cases for blockchain across the banking system. These included the following:

- Retail Banking - remittance services, KYC for credit card usage

- Commercial Banking - corporate debt, syndicated loans

- Payments - international correspondent banking method

- Trade Finance - trade settlement, letter of credit

- Insurance - document authentication, providence

- Treasury - derivative security trading

The other conference speakers covered how some of these areas might be enabled by their respective distributed ledger technologies, with Ripple CEO Chris Larsen speaking of payment rails for global real-time settlement, Symbiont CEO Mark Smith emphasizing smart contracts for securities settlement, and Everledger CEO Leanne Kemp and Ascribe CEO Bruce Pon jointly presenting the Bigchain DB blockchain identification tool.