IBM InterConnect and identity and authentication provider SecureKey Technologies have announced they are working together to enable a new digital identity and attribute sharing network based on IBM Blockchain. The network will be designed to make it easier for consumers to verify they are who they say they are, in a privacy-enhanced, security-rich and efficient way. When launched later this year, consumers will be able to use the network to instantly verify their identity for services such as new bank accounts, driver’s licenses or utilities.

Together, the two companies are developing the network with IBM’s Blockchain service which is built on top of the Linux Foundation’s open source Hyperledger Fabric v1.0. As a permissioned blockchain, the Hyperledger Fabric is an essential component in delivering services that comply with regulations where data protection and confidentiality matter, particularly for regulated industries.

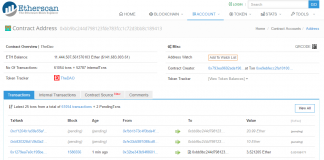

The network is currently in the testing phase in Canada and, when it goes live later this year, Canadian consumers will be able to opt-in to the new blockchain-based service using a mobile app. Consumers will be able to control what identifying information they share from trusted credentials to the organizations of their choice, for those organizations to quickly and efficiently validate the consumer’s identity and arrange new services. A possible use could be if a consumer has proven their identity with their bank and a credit agency, they can grant permission to share their data with a utility to create a new account. Since the bank and the credit agency have already gone through extensive verification of the consumer’s identity, the utility can choose to rely on the fact that the information is verified, and the consumer can be approved for new services.

Marie Wieck, general manager for IBM Blockchain, commented: “What IBM is building with SecureKey and members of the digital identity ecosystem in Canada, including major banks, telecom companies and government agencies, will help tackle the toughest challenges surrounding identity. This method is an entirely different approach to identity verification, and together with SecureKey, we have a head start on putting it on the blockchain. This is a prime example of the type of innovation permissioned blockchain networks can accelerate.”

Founder and CEO of SecureKey Technologies, Greg Wolfond said: “Hyperledger Fabric is by far the most advanced permissioned-blockchain technology available today, in my opinion, both in protecting user data and allowing us to work within the context of industry and country privacy laws. Among the many contributors to Hyperledger Fabric including SecureKey, IBM is a standout innovator that has proven that they can rapidly bring blockchain solutions to production. We are very excited to enter into this formal agreement that will benefit consumers around the world.”

Canada’s leading banks, including BMO, CIBC, Desjardins, RBC, Scotiabank and TD joined the digital identity ecosystem in October, 2016, investing $27M collectively in SecureKey. The Digital ID and Authentication Council of Canada (DIACC) and the Command Control and Interoperability Center for Advanced Data Analytics (CCICADA), a research centre of excellence funded by the U.S. Department of Homeland Security Science & Technology Directorate, have also provided funding to bring the new approach to digital identity to market.

Andrew Irvine, Head of Commercial Banking and Partnerships at BMO Bank of Montreal, remarked: “Our goal for this partnership is to accelerate the pace at which we can develop a service to help consumers better manage, protect and control their digital assets and identity, and ultimately provide our customers with greater convenience and a better overall experience,”

Senior Vice President of Innovation at CIBC, Todd Roberts stated: “Implementing forward thinking innovation is key to ensuring our clients have the best possible experience in today’s digital environment. We are pleased to continue working with SecureKey to implement leading edge technology that protects our clients’ security and privacy in the digital ecosystem.”

Patrice Group explained: “We believe that combining SecureKey’s expertise and innovation in identity and the technological knowledge and leadership of Hyperledger Fabric and IBM Blockchain’s High Security Business Network will be foundational in delivering a great identity solution for consumers in Canada and also help pave the way at the international level,”

VP of Solution Acceleration and Innovation at RBC, Eddy Ortiz said: “Collaborating with partners like SecureKey and IBM in the development and implementation of solutions that make our clients’ interactions secure and seamless is essential to meeting evolving expectations in a digital world. Canada has an important opportunity to innovate with emerging technologies like blockchain to advance digital identity in Canada.”

Mike Henry, Executive Vice President for Retail Payments, Deposits and Unsecured Lending at Scotiabank, noted: “Scotiabank is embracing digital technologies like blockchain to offer a superior customer experience and to make it easier for customers to bank with us whenever they want and wherever they are,” “We are pleased to work with SecureKey and other innovative partners to provide Canadian consumers with an easy and secure privacy-enhanced digital ID process.”

Chief Digital Officer at TD, Rizwan Khalfan commented: “Helping Canadians control the security of their personal data to reduce the risk of fraud online, in person, or over the phone is innovating with purpose. We are thrilled to work with SecureKey and its partners in the creation of an innovative identity ecosystem designed to allow our customers to digitally and securely validate their identity, when and how they want to.”