D+H, a Toronto-based financial technology provider that earned $800 million in 2014, announced this week that it has integrated distributed ledger technology into its global payments services hub.

The blockchain solution was built as an extension of D+H’s Global PAYplus solution, which helps financial institutions manage multiple payment types, including high value, mass and immediate payments, and currencies, domestically and across national borders.

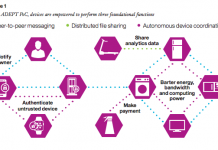

According to D+H, financial institutions using its payments hub can now access a secure, closed loop distributed ledger system to connect bank networks, move money in real-time, and improve access to liquidity. Using the solution, peer-to-peer payments can be made in real-time, benefitting from the anonymity inherent in blockchain technology to ensure security and reduce risk.

Moti Porath, D+H’s executive vice president, Global Pre-Sales.

D+H has made significant investments in blockchain and distributed ledger innovation, and will continue to explore new use cases and partner with players like Ripple to pursue other opportunities.

Porath chatted to AllCoinNews about D+H’s distributed ledger technology.

ACN: What blockchain is D&H using for its banking solutions?

D+H is using a multi-chain, private blockchain.

ACN: What types of customers does your solution serve? In what countries?

Our global payments services hub serves banks and their corporate customers, globally, including some of the largest banks in the world.

ACN: What is the origin of your company?

With nearly 140 years of experience, D+H is the leading end-to-end provider of retail, commercial and transaction banking solutions. We offer lending, payments, enterprise and global transaction banking hubs that are used by nearly 8,000 financial institutions and corporations. Our payments services hub. integrates different payment types, currencies and systems into a single centralized payments hub and provides for mass, high value and immediate payments. and enables financial institutions and their business customers to manage and process payments, and transfer funds in local and international environments in a cost-effective, secure and reliable way. It helps financial institutions of every size to manage all types of payments, within and across national borders

ACN: Why did you decide to start blockchain-based solutions?

D+H decided to provide blockchain capabilities because it is the future of payments technology. Some of the largest banks in the world – from Barclays, BAML, to Citi – now realize blockchain’s potential to disrupt how payments, such as P2P payments, are conducted, processed and delivered. Many of these banks have commenced testing on technologies to leverage blockchain. We seek to support new technologies and allow customers to future proof their payments investment, help them to simplify and reduce the costs associated with clearing , and help them achieve their objectives related to immediate payments.

ACN: Is your platform proprietary, in house developed? Do you offer an API?

It was built in-house using open standards. We use web services by exposing a WSDL

ACN: Are you using Ripple’s platform?

No. D+H does provide direct access to Ripple, but this solution is not based on the Ripple platform and can provide access to any number of real-time gross settlement systems.