Seven European financial institutions have partnered to develop a post-trade blockchain infrastructure to allow small and middle-sized enterprises (SMEs) in Europe to raise funds more easily on capital markets.

Taking the form a Memorandum of Understanding, the new collaboration will focus on improving SMEs’ access to capital markets while facilitating secure and transparent post-trade operations.

BNP Paribas Securities, Caisse des Depots, Euroclear, Euronext, S2iEM and Societe General, in collaboration with Paris EUROPLACE, a non-profit organization aimed at developing and promoting Paris’ financial hub, are part of the initiative.

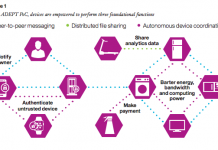

Combining their financial capacities and expertise, the new partners said they intend to launch a new independent company whose mission will be to harness the benefits of blockchain technology for the design, development and deployment of solutions for post-trade.

Blockchain technology could substantially facilitate securities registration for the European market, allowing thus for enhanced and streamlined post-trade operations. This includes much faster execution of trades with clearing and settlement in real time at T+0.

“We wanted to engage collaboratively in order to mount an innovative project with the potential to drive the transformation of the post-trade market,” the companies said in a joint statement.

The statement reads:

“By pooling our strengths in this ground-breaking area, we are focusing on new solutions that will give small and middle sized companies - key actors for growth in Europe - easier access to the financing they need. With this project, we are securing the means to seize opportunities that blockchain distribution can offer: speed of execution, low cost and security.”

In a separate announcement, Euroclear, a Belgian provider of post-trade services, has announced a new collaboration with itBit to explore opportunities for creating a blockchain-powered settlement service for the London gold market.

The collaboration, announced on June 21, will find the companies utilizing itBit’s proprietary blockchain infrastructure technology and flagshit product, Bankchain, to develop a solution that would minimize risk leading to a reduced capital charge, deliver true delivery versus payment and reduce balance sheet constraints.

France gears up for blockchain technology

The moves come at a time when an increasing number of French banks and financial institutions are starting to experiment with blockchain technology.

Apart from the new collaboration, BNP Paribas and Societe Generale are also members of R3’s blockchain consortium.

Separately, BNP Paribas Securities Services, the group’s asset services division, is working with SmartAngels to create a platform that would leverage blockchain technology to enable private companies to issue securities. A pilot is expected to be launched in the second half of 2016.

This week, the Viva Technology International summit is being hosted in Paris. The three-day event, one of the world’s largest gatherings dedicated to technology, features a series of open innovation challenges, among which four blockchain-dedicated startup competitions.

At the event, three particular firms have expressed their interest in blockchain technology for use in their respective sectors.

BNP Paribas is particularly interested in its use to improve and simplify customer authentication. AXA on the other hand, is seeking a blockchain solution to record and authenticate each phase of the contract lifecycle. Finally, consultancy firm EY is looking for a blockchain solution to automate financial statement verification and certification.