Blockchain Inspector, based in the French commune of Angoulême, is an early stage startup aiming to use blockchain to combat fraud. In March, they signed a deal with their first customer, a London Bitcoin exchange, to help it comply with regulations. We have Interviewed the founder and CEO, Stéphane Traumat.

What does Blockchain Inspector enable?

Blockchain Inspector is a blockchain fraud detection tool. Our tool can help prevent identity theft, financial fraud, money laundering and terrorist financing. The goal is to help our client comply with Know Your Customer (KYC) and Anti Money Laundering (AML) regulations regardless of how they use the blockchain.

How does Blockchain Inspector work?

Thanks to our artificial intelligence tool, our clients can create rules to profile unknown blockchain users, track and respond to their behaviours. The key advantage of our solution is that it allows for human reasoning to be integrated a computer system capable of processing very large amounts of data. Our AI tool is already used to simulate crowds in theme parks or to build self-driving cars.

Who can use Blockchain Inspector?

Financial services, Fintech, institutional clients and law enforcement agencies.

What are the next plans?

The next step is to make our software work with the real world data of our first client. We expect our solution to work perfectly in September. Then, we will be looking for investors to support our international business development.

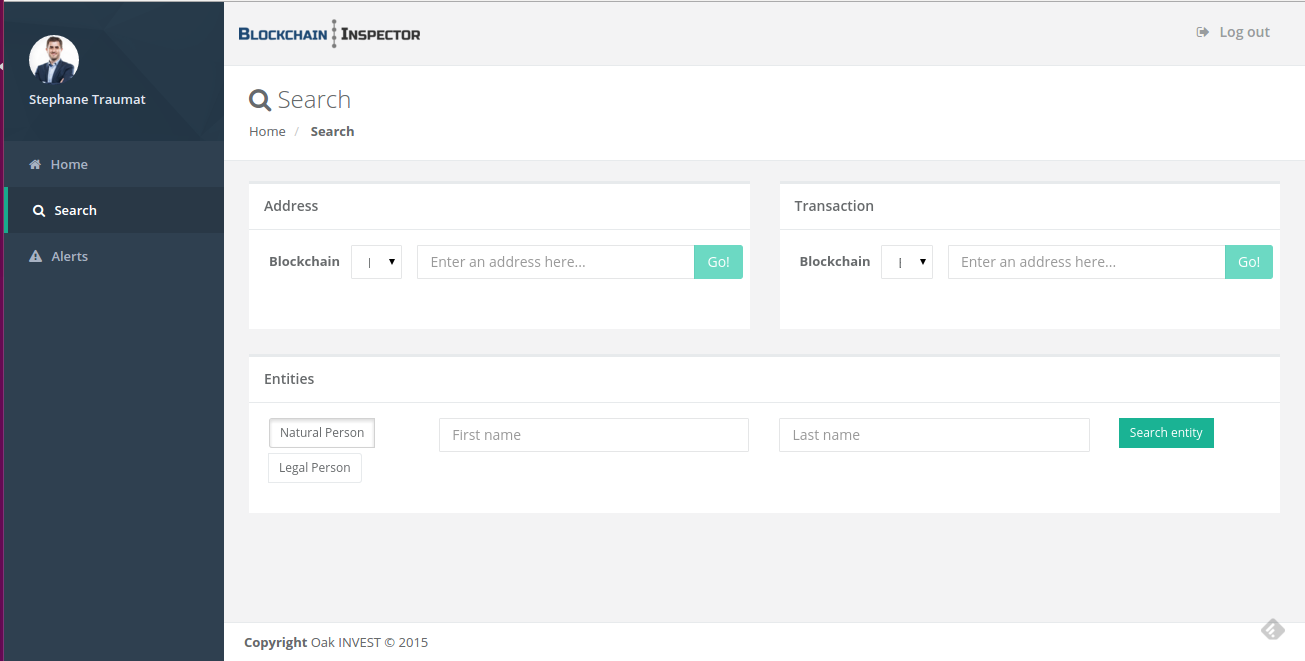

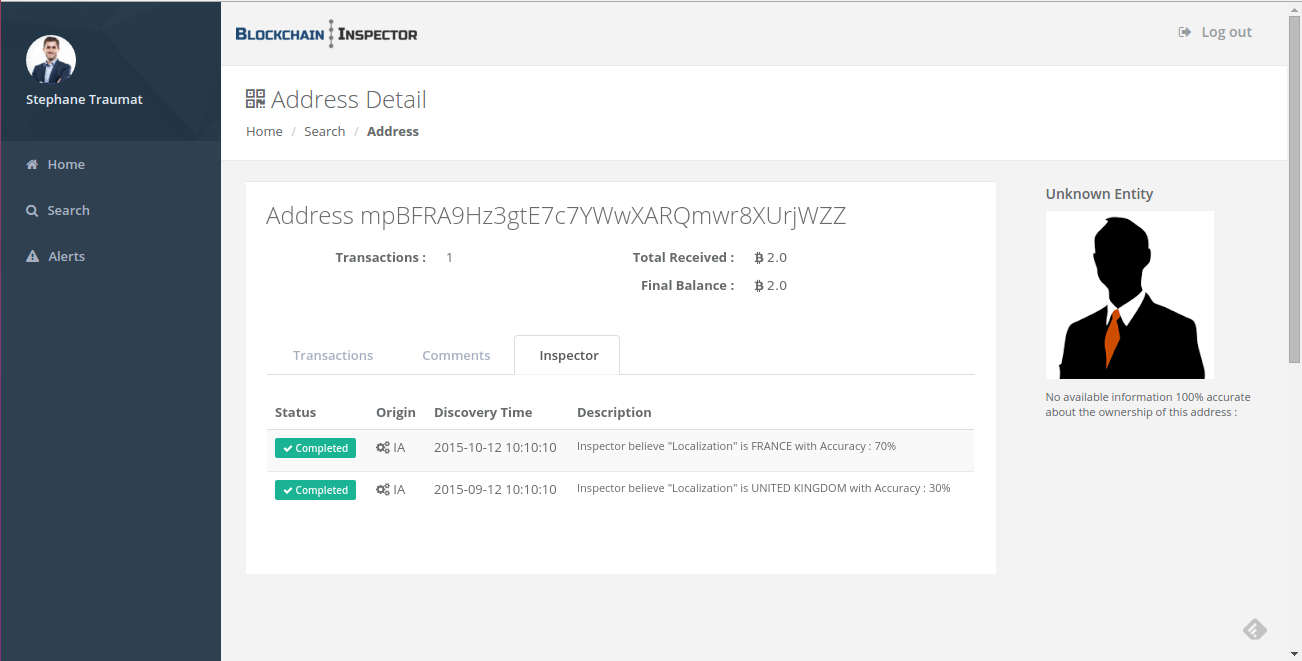

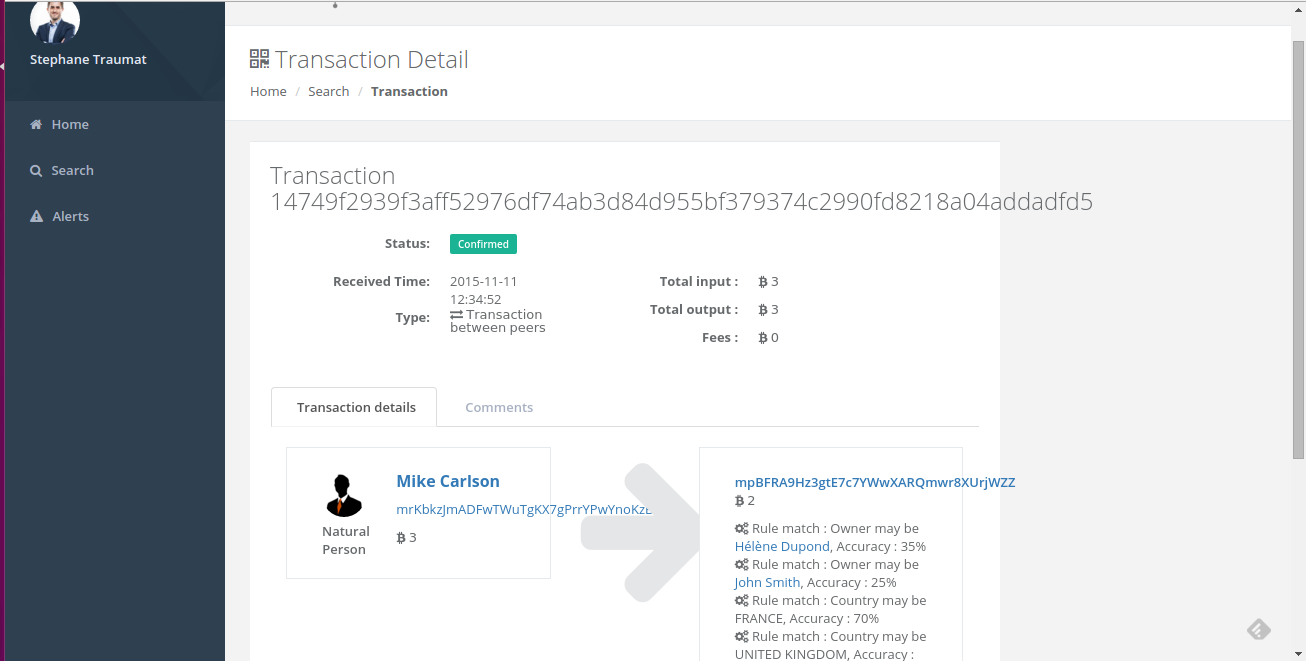

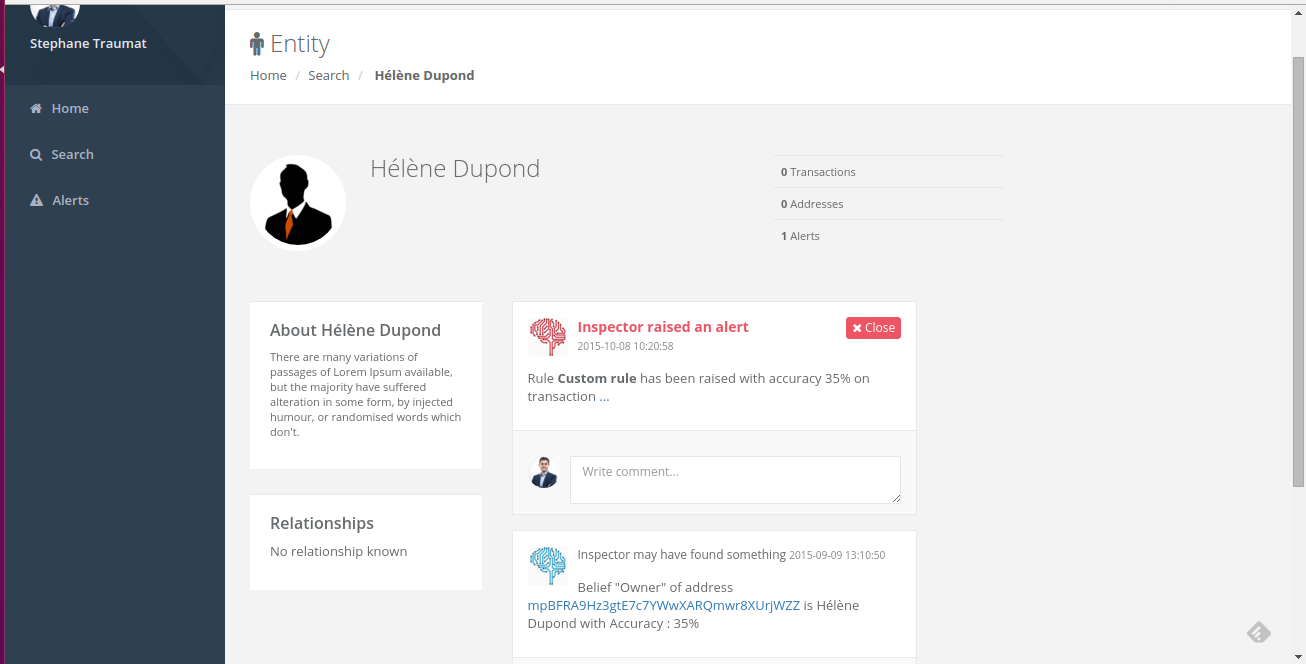

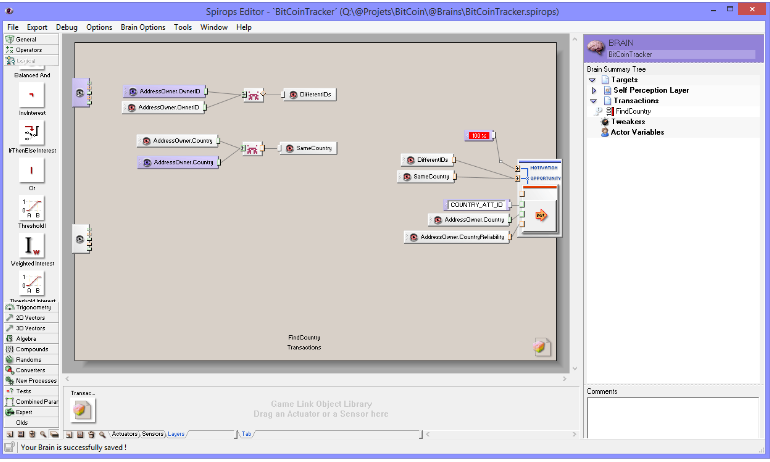

The following screenshots show examples of what Blockchain Inspector enables:

Enter your search for an address…

This screenshot shows two AI rules led to possible results for the owner’s country.

Blockchain Inspector shows possible transaction partners.

Here, an alert has been raised as it seemed the user made a transfer to a country under embargo.

Rules creation